You’re super excited to start selling info products.

But, you also know there’s more to starting your own business than simply releasing a product into the world.

What about taxes?

And legalities and hiring employees?

Don’t worry, we’ve got you.

Whether you plan to sell online courses, offer an ebook, or sell digital downloads, we bring you everything you need to know about business basics in today’s guide.

To help you launch your online business the right way, we cover four key categories you need to know when starting to sell info products.

First on the docket, let’s look at when and why you should incorporate your side-business.

#1. When and why to make your side-hustle an official business

If you’re considering turning your side-hustle into an official business, there are several benefits that come with incorporating your business.

(In case you’re unfamiliar, incorporating your business means formally creating a corporation that’s a legal entity, which is separate from you personally.)

To name a few of the benefits of incorporating your business:

-

You’re seen as more professional, legitimate, and trustworthy

-

You potentially lower your taxes

-

You can reduce your legal liability

Let’s quickly dive into these benefits of incorporating your business, the first being appearing more professional.

If you’re not convinced that looking more legit makes a difference, consider successful entrepreneur, Stephanie Krikorian, who turned her freelance writing into an LLC. Stephanie found that presenting herself as a business helped her earn more clients.

What’s more, when you’re an official business, not only do clients take you more seriously, but banks do, too.

Which is especially important if you’re looking to get a loan. In fact, 70% of business owners who didn’t have an official bank account were denied a business loan in the past two years.

Another perk of incorporating your business is the potential tax breaks.

For instance, 15 million taxpayers claimed the Qualified Business Income (QBI) deduction -- which lets you deduct up to 20% of your business income -- in 2018.

This, of course, depends on your tax situation, but the gist is if you incorporate your business, you may have tax benefits.

Finally, the third advantage of incorporating your small business, limiting your legal liability, is key when it comes to legally protecting your personal assets.

Otherwise, you might find yourself at risk of losing a lawsuit -- or worse, everything you own -- if anything goes awry. As lawyer Gahram Kang, Esq. explains, when you operate as a sole proprietor, your personal assets are on the line if your business is ever sued.

As for when to incorporate your business, four scenarios that present ideal situations for taking the plunge are:

-

#1. Straight out of the gate when you start your business -- that way, you don’t have to deal with switching up your structure later

-

#2. Before signing any legally binding contracts -- this will alleviate some of your personal liability

-

#3. When your income reaches a significant (to you) amount that’s worth protecting

-

#4. Before hiring your first employee, in case you get into any legal issues involving your team members

Speaking of legalities and taxes, let’s head into our next topic.

#2. Small business legalities and taxes

With several legal and tax requirements for starting a small business, it’s a challenge knowing where to start. We recommend picking a business structure as your first step.

For entrepreneurs in the U.S., five main business structures to choose from are:

-

Sole proprietorships

-

Partnerships

-

Corporations

-

S corporations

-

Limited liability companies

(For business structures in Europe, check out this resource for starting a business in the E.U.)

Once you’ve got your structure set up, it’s about getting to know, and fulfilling, your region’s specific laws and requirements.

If you’re in the U.S., for example, you’ll need to register a fictitious business name and likely pay for a doing-business-as (DBA) name. You may also be required to get an employer identification number (EIN) and sales tax ID.

Requirements vary, not only across countries, but from state to state, too.

So, with all these legal nuances that differ across locations, what’s your best bet?

Seek legal counsel from an accountant and lawyer to cover your bases.

Chances are, there’s more under the hood that you need to learn about to make the best choices for your business.

Like familiarizing yourself with employment laws, such as the difference between employee and contractor designations, so you don’t violate any labor laws.

Not to mention the onslaught of tax details that you need to heed, which makes professional advice extra handy come tax time.

Let’s dig into some tax requirements to see what I mean.

In the U.S., self-employed entrepreneurs have to pay federal taxes according to a tier of tax brackets.

Then, depending on where you live, there’s also state, local, and/or additional taxes.

For entrepreneurs based in Europe, there are both E.U. taxes and VAT tax to pay.

On top of that, all self-employment income in the U.S. is subject to a self-employment tax of 15.3% that’s made up of 12.4% for social security and 2.9% for Medicare.

Since you’ll be responsible for paying your federal, state, and local taxes yourself, it’s wise to set aside money from each sale to pay your taxes on the quarterly tax date.

As for how much to set aside, you can reference this table of state and local taxes for an idea of what you may owe.

While it’s a decent guideline to follow, your state’s and city’s websites will have more accurate and updated rates. Plus, your accountant should be on top of knowing them.

But OK. That covers income taxes. There are still sales and use taxes to pay.

Most states charge sales tax, which means, if you’re in one of those states, you need to collect sales tax from your customers and send it to the government on your behalf.

Otherwise, the government collects use tax, which is a tax imposed when consumers don’t pay sales tax at the time of purchase.

Phew -- had enough of the legalities and tax talk? Us, too.

The main takeaway is when it comes to legalities and taxes, there’s more than enough to worry about, and the laws vary across locations, so consult an accountant and/or lawyer to be extra safe.

And when you’re not consulting with your professional advisors, look to business finance tools to help you stay organized.

#3. The best tools for managing your business’ finances

These days, there are plenty of small business accounting software programs to help keep your business finances in order.

Just like anything in your business, it’s important to choose the right tool for you and your business.

If you’re a creator who wants an all-in-one account platform, check out FreshBooks, one of the most popular small business accounting tools.

FreshBooks includes features like expense and time tracking, payment processing, and customizing proposals and invoices.

QuickBooks is another solid option if you want an accounting program that makes it easy to track and pay your taxes and maximize your tax deductions.

As for features, QuickBooks lets you track income and expenses, manage sales and sales tax, import expenses, and also organize your expenses into categories that maximize your potential deductions.

For an accounting tool that offers a generous free plan, look to Wave.

Wave is an accounting and invoicing program that lets you organize your income, expenses, invoices, and payments, as well as manage double-entry accounting. You can manage multiple businesses from one account, too.

Regardless of the accounting tool you go with, using software to help organize your business finances can work wonders.

If you’re on the fence about investing in an accounting tool, consider the peace of mind and time savings it may bring you.

An astonishing 69% of small business owners are kept up at night worrying about their cash flow, and 38% of business owners spend over 100 hours managing their federal taxes alone.

And if you’re among the 40% of entrepreneurs who think bookkeeping and taxes are the worst part of being a small business owner, an accounting program simplifies and organizes your finances, too.

Basically, accounting tools help you manage your cash flow, budget, and expenses as cleanly as possible, which will help you tremendously during tax time and while running a growing business overall.

And with a crystal-clear understanding of your business finances, you’ll know when your budget will allow for hiring help - our final topic today.

#4. How to find, hire, and manage freelancers in your business

When you’re ready to hire team members for your business, we recommend following 6 key steps for finding and hiring freelancers.

The first step is figuring out what you need help with.

With the average business owner being responsible for an average of 4.2 roles, it’s no surprise that 37% of small businesses outsource some business process.

When hiring freelancers to help you, it’s vital to clearly define which parts of your business processes you want to delegate.

If you’re wondering where to start, consider giving freelancers tasks that are:

-

Beyond your area of expertise, and/or

-

Consume way too much of your time

Once you have your freelancer tasks outlined, it’s time to determine your budget, which varies widely depending on the skill set and niche you’re hiring for.

An SEO budget, for example, averages $497.16 monthly, while a freelance writer might cost less than $20 per hour.

Generally speaking, if this is your first hire and you want to start off with a smaller budget, set aside $100 to $200 per month and work up from there.

Your next step is to search for freelancers and talent, which you can do using marketplaces like Upwork and PeoplePerHour.

If you want to find freelancers in specific niches, consider DesignCrowd for graphic designers or Zirtual for a top virtual assistant (VA) service.

Alternatively, you can hire freelancers directly from their websites, too, like Lianna Patch of Punchline for copywriting or Peter Brady, who’s a Drupal developer.

Once you’ve found a handful of freelancers you like, reach out to them and include:

-

A short overview of you and your business

-

The scope of your project and what you want the freelancer to complete

-

The timeframe for everything and/or if you want help on a recurring basis

-

How often you want to connect for progress updates

As you contact freelancer candidates, ask them about their availability and if they have questions about your tasks. Anywhere you can clarify your project will help you avoid miscommunication down the road.

Which includes discussing details, like project and task delivery and compensation.

When it comes to paying your freelancers, not only can you do your part by paying them fairly, you can also pay them on time.

Sadly, an alarming 54% of freelancers claim they don’t get paid in a timely manner, so being on top of your bills will boost your relationship with them.

Beyond that, it’s about clearly communicating your expectations and the scope of work, and building a healthy work relationship with your freelancers by regularly checking in and chatting about their progress and goals.

In a nutshell:

First, clarify what you want your freelancer to take on, then work out your budget. When you’re ready to search for talent, check marketplaces and freelancer sites directly. Then, reach out to candidates and agree on the scope of work, expectations, timeframe, and payment.

The rest is about maintaining regular communication and nurturing your relationship with freelancers.

It’s time to launch your info products into the world

Starting an info product business isn’t difficult, but it will require some research, planning, and elbow grease.

Let’s recap:

-

#1. The benefits of turning your side-hustle into an official business include appearing more professional, possibly shrinking your tax bill, and reducing your liability.

-

#2. Get to know the business rules and taxes specific to your nation, state, and city. Hire a professional accountant and lawyer for extra security.

-

#3. Use an accounting software to help streamline and organize your business finances.

-

#4. Hire freelancers to help you grow your info product business.

With the right guidance in your toolbox, you’re ready to take on the world of selling info products.

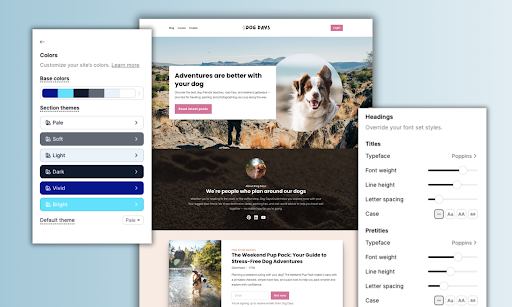

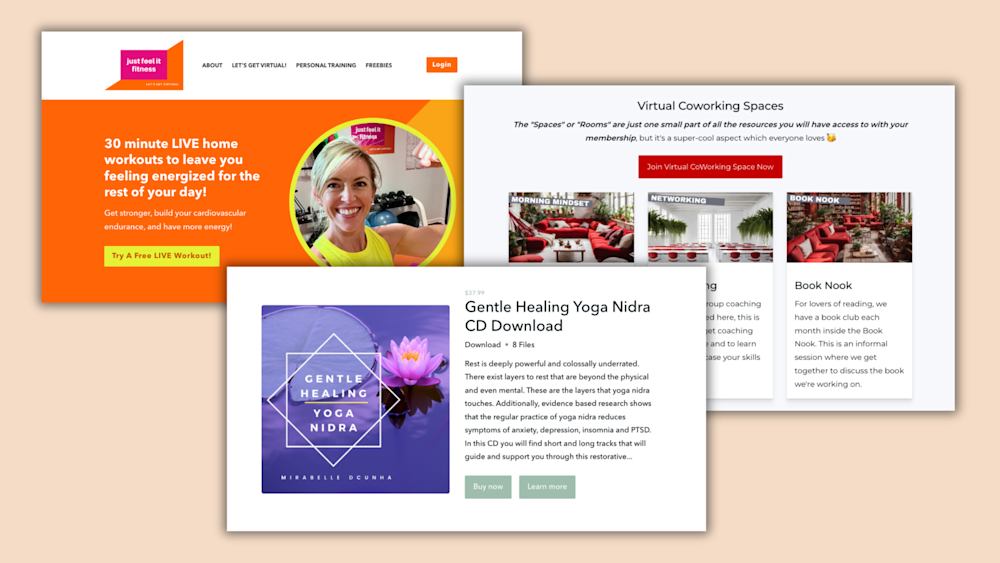

Good luck, and if you should need a platform to host your info products once they’re out in the world, we’ve got you covered with this free, hassle-free trial with Podia right over here.