It’s time to admit something: Our math teachers were right.

We do need to use math in the real world.

If you’re anything like me — not a math person — this is kind of a bummer. But as a small business owner, you play many different roles, and sometimes, marketer and mathematician end up on that list.

Don’t worry — you don’t need pre-calculus or geometry for marketing math. With a simple spreadsheet, these marketing math formulas can give you valuable insight into your customers, sales, and marketing.

In this guide, we’re sharing the marketing math formulas every small business owner should know.

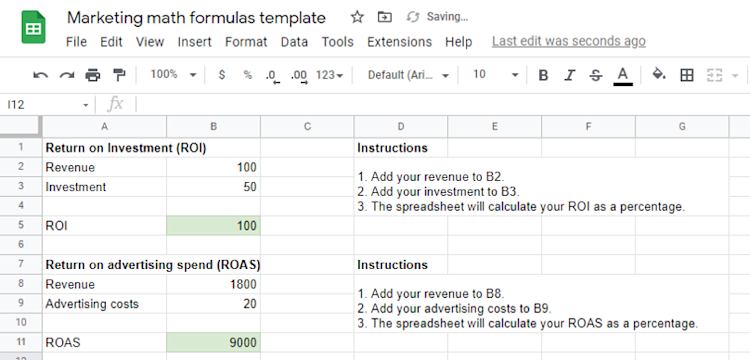

We’ll walk through how to use each formula, plus how to use our Google Sheets spreadsheet template to calculate these marketing metrics, no TI-84 calculator or scratch paper required.

Download the marketing math spreadsheet template here to follow along.

Let’s get started with a classic marketing calculation: return on investment.

How to calculate return on investment (ROI)

Return on investment (ROI) measures how much you earn from any given investment. In other words, how much of the money you put in did you get back?

Calculating ROI is one of the best ways to determine how the time and money you put into your marketing campaigns affect your bottom line.

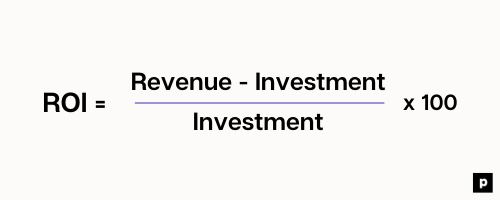

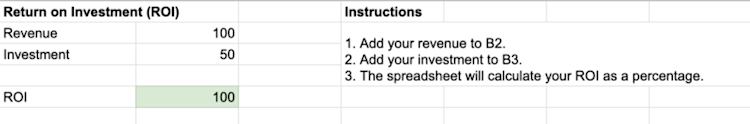

In simple terms, the ROI formula is (Revenue — Investment) / Investment. It’s typically expressed as a percentage, so multiply your result by 100.

In our spreadsheet, ROI is in the first tab. Add your revenue to cell B2 and your investment to B3, and the spreadsheet will calculate your ROI as a percentage.

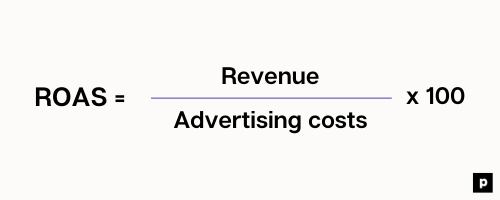

In marketing, you’ll often see another key performance indicator (KPI) called return on ad spend (ROAS). When you calculate ROAS, your investment is how much you spend on advertising, and your sales revenue is how much money you made from that advertising.

It’s time to look at ROAS in action.

Let’s say that you want to get your online course in front of more potential students and decide to use Facebook ads to do so. Facebook is one of the most affordable and effective social media platforms for paid social ads, with an average conversion rate of 9.21%.

You spend $20 on your Facebook ad campaign, your ads reach 200 Facebook users, and 9% of them convert — right at the benchmark.

That means that 18 people buy your course at $100 a pop, adding up to $1800 in revenue.

Let’s calculate your ROAS using our Google Sheet template. Add your revenue ($1800) to cell B8 and your advertising costs ($20) to B9.

Your ROAS for your Facebook ad campaign is 9000%, or 90:1. In other words, for every $1 you spend on your ads, you bring in $90.

Once you calculate your marketing ROI and ROAS for different channels, you can figure out how your marketing activities individually contribute to your success. Then, you can decrease or increase your investment in different marketing initiatives based on your calculations.

In our example above, Facebook seems like it’s working wonders for you to connect with your audience, so you might want to increase your social media ad budget in the future.

Our next marketing formula can also help you figure out how well your marketing works, so you can make the most of your marketing spending. Keep reading to learn more.

How to calculate customer acquisition cost (CAC)

Your customer acquisition cost (CAC) tells you how much it costs to acquire a new customer.

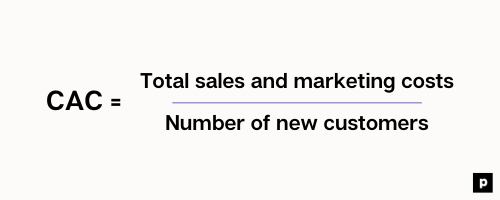

The formula for CAC is total sales and marketing costs / number of new customers.

By adding up the total marketing costs for a given period and dividing them by the number of new customers for that period, this metric gives your team insight into how much it costs your company to acquire a new customer.

CAC costs can include fixed costs, like website hosting and marketing platforms, and variable costs, like the cost per click on paid advertising.

What does CAC look like in action?

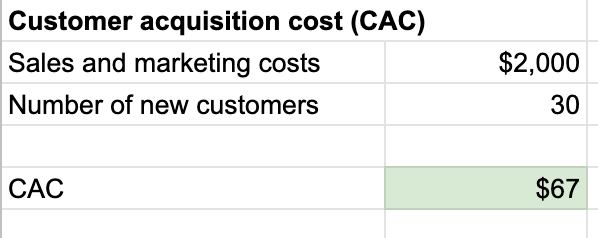

You’re creating a marketing plan for your online community launch, and your sales and digital marketing costs add up to $2,000.

During your initial marketing activities, you bring in 30 new community members.

In our spreadsheet, CAC is in the second tab. Enter your total marketing costs in cell B2, then your total number of new customers in B3.

Your customer acquisition cost is about $67/customer.

You can also split up CAC by marketing platform, so you can see the direct costs of acquiring a customer from each separate channel.

One great way to lower your CAC is to use an all-in-one platform, rather than paying and trying to wrangle several different marketing tools.

Podia’s all-in-one platform lets you run your email marketing, create a website and landing pages, and sell your digital products all from one dashboard. Get started today with a free 30-day trial.

CAC is an important metric because it helps you figure out whether you’re spending more on acquiring new customers than you can afford. It also serves as a basis for another key marketing KPI: Time to pay back CAC.

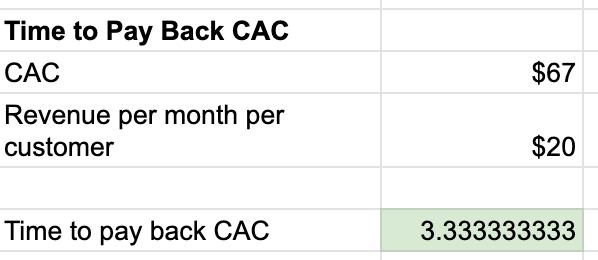

Time to pay back CAC tells you the number of months it will take you to earn back the CAC you spent to acquire a customer.

This is key if you have a recurring billing business model, like a monthly or annual membership. If your average member leaves before you earn back your CAC, you’ll end up losing money.

Going back to our example, let’s say that your brand community membership costs $20/month.

In your spreadsheet, you can calculate your time to pay back CAC by entering your revenue per month per customer (in this case, $20) in cell B9.

It’ll take a little less than three and a half months to make back the money you spent to acquire a new member. In other words, if you pay $67 to acquire a customer, you’ll break even and start to make money from the member about three and a half months in.

You might also hear this calculation referred to as break-even analysis, which means figuring out how long it’ll take you to start netting a profit.

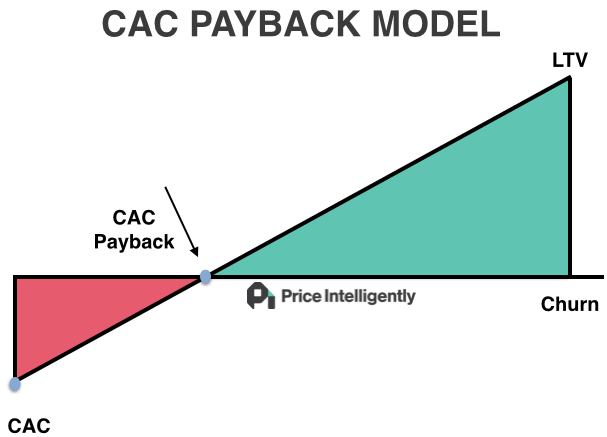

In the graph below, the red area depicts the acquisition process where your business is spending time and money to bring in new customers.

As time passes and your members pay monthly, you’ll eventually break even and make your money back on your initial acquisition costs. From there, you’ll continue bringing in a profit from that customer until they churn.

We’ll talk more about customer churn later on. For now, let’s talk about another metric that helps you determine whether you’re making the most of your marketing spend and bringing in valuable customers.

How to calculate customer lifetime value (LTV)

Customer lifetime value (CLTV or LTV) is the predicted amount of revenue that a customer will generate throughout their entire relationship with your business.

LTV can be a bit more complex to calculate than our last two metrics. To calculate your LTV, you need to know a few different factors:

-

Average purchase value: If you only sell a monthly membership, this is your monthly subscription cost. If you sell multiple products, divide your total revenue in a time period (one year) by the number of purchases over the course of that same period.

-

Average purchase frequency: Divide the number of purchases over the course of one year by the number of customers who made a purchase during that year.

-

Average customer value: Multiply the average purchase value by the average purchase frequency.

-

Average customer lifespan: This refers to how many years the average customer continues to buy from you. It’s hard to know this number, especially if you’re a new business. Analytics expert Avinash Kaushik recommends using three years as an estimate.

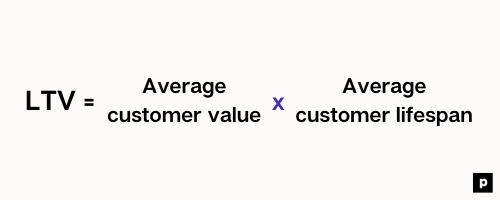

Calculate your LTV by multiplying your average customer value by your average customer lifespan.

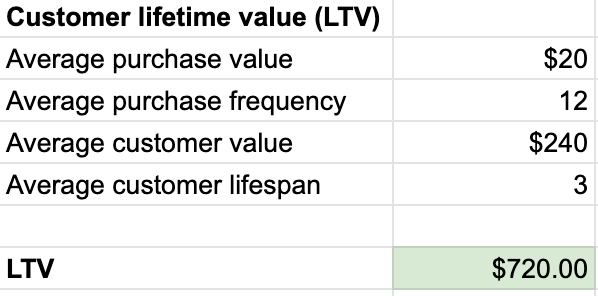

If that seems like a lot of numbers, take a pause. Let’s break it down and continue with our membership example from the last section.

-

Average purchase value: Your monthly membership costs $20.

-

Average purchase frequency: Your members pay once a month for a monthly membership, so your average purchase frequency is 12 times per year.

-

Average customer value: $20/month x 12 purchases per year = $240/year. Your average member brings in $240/year.

-

Average customer lifespan: 3 years (based on the estimate from ecommerce experts).

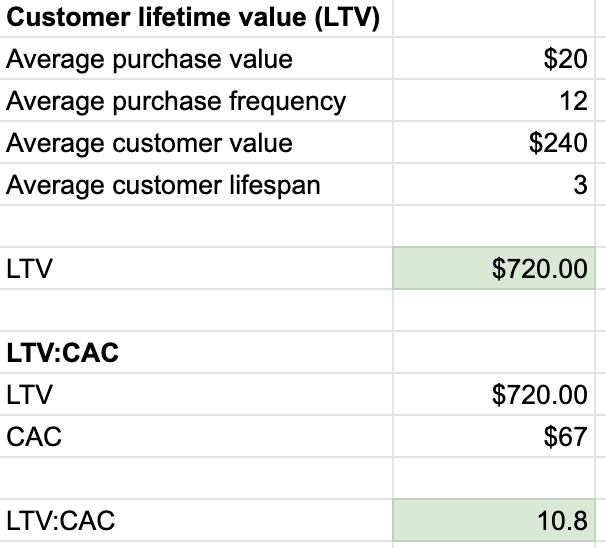

In our spreadsheet, enter your average purchase value in B2, your average purchase frequency in B3, and your average customer lifespan in B5. The spreadsheet will automatically calculate your average customer value for you.

Next, calculate LTV by multiplying average customer value by the average customer lifespan. This will give you an estimate of how much revenue you can reasonably expect an average customer to generate for your company over the course of their relationship with you.

So, how does knowing your LTV help you get more out of your marketing?

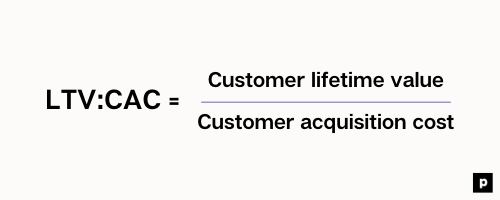

Once you have your LTV, you can calculate the ratio of LTV:CAC. LTV:CAC gives you a cost-benefit analysis of your current acquisition process. To put it more simply, LTV:CAC tells you whether you’re spending too much or too little to bring in new customers.

Our spreadsheet will automatically pull your CAC and LTV to calculate your LTV:CAC ratio.

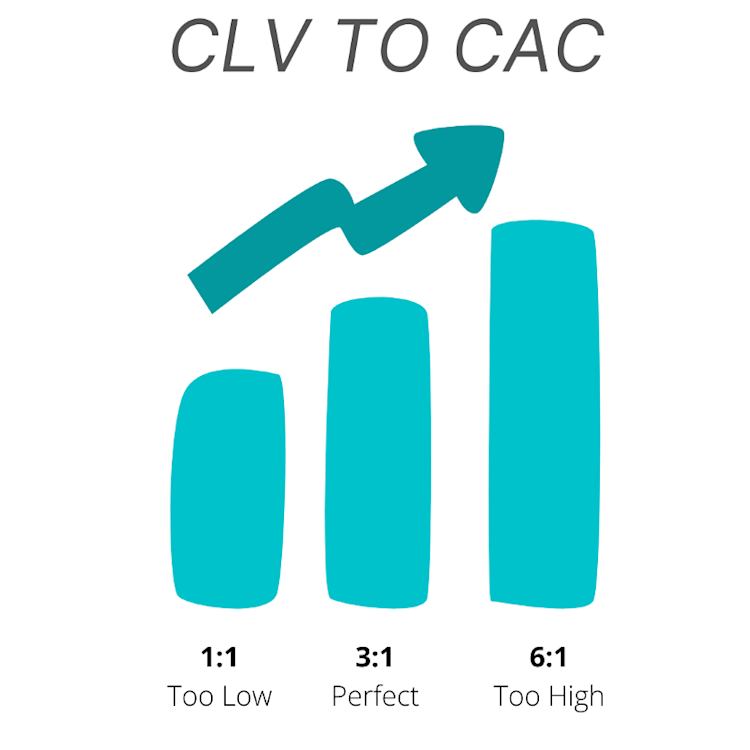

In our example, your LTV:CAC is 10.8:1, which is quite high. An ideal LTV:CAC ratio is 3:1, meaning that the value of your customer is three times more than the cost to acquire them.

If your ratio is close to 1:1, it means you’re hardly breaking even. That means that the higher the ratio, the better, right?

Maybe not. Too high of an LTV:CAC ratio — like our 10.8:1 — can indicate that you’re making a marketing mistake and missing out on potential customers by not spending enough on acquisition.

Try exploring new channels, like starting a blog, or investing more into the channels that already work well for you, like Facebook ads or email marketing.

Then, track your LTV:CAC over time to figure out which adjustments help you find the sweet spot between 3:1 and 6:1. This requires some time, plus trial and error, but once you find the right balance, your hard work and patience will pay off.

Not that there won’t be a few losses along the way. Our next calculation tells you how to track them.

How to calculate customer churn rate

Customer churn — also known as customer attrition — is when repeat customers leave your business.

When we talk about customer churn, we’re usually referring to when customers stop making recurring payments, like a monthly community membership or subscription plan.

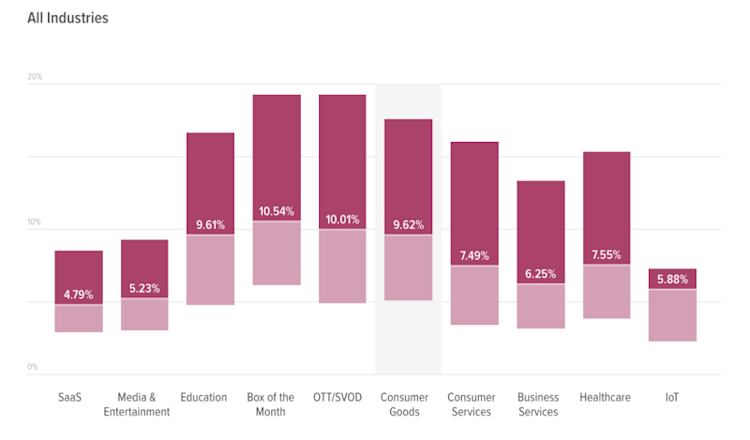

Churn is a natural part of running a business, especially when you have a recurring billing model like a monthly or annual online membership. As a benchmark, the overall churn rate across subscription businesses is 5.60%.

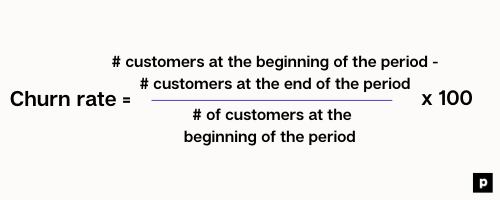

To calculate your churn rate:

-

Subtract the number of customers you had at the end of a period (such as a month or year) from the number of customers you had at the beginning of the period.

-

Divide that number by the number of customers you had at the beginning of the period.

-

Multiply by 100 to get a percentage.

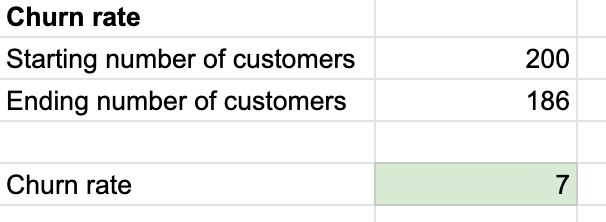

Let’s say you want to calculate the monthly churn rate for your membership community. On January 1, you have 200 members. On January 31, you have 186 members.

In our spreadsheet, enter the starting number of customers in cell B2 and the ending number of customers in cell B3. The spreadsheet will calculate your churn rate as a percentage in cell B5.

Your churn rate here is 7%, which is just a little bit higher than the benchmark for subscription businesses. This means you retain 93% of your customers month-over-month.

If your churn rate is too high, that means your customers aren’t sticking around for very long. They may be having a negative customer experience or no longer finding value in your membership or products.

Make the most of your marketing with some simple math

You don’t need to be a calculus whiz kid to learn and use marketing math formulas. With a simple spreadsheet, these calculations and metrics can give you valuable insight into your marketing strategy and help you grow your business.

To recap, here are four must-have marketing formulas every creator should know:

-

Return on investment (ROI) tells you how much you earn from any given investment. ROI and return on ad spend (ROAS) help you determine how different marketing activities contribute to your bottom line.

-

Customer acquisition cost (CAC) tells you how much it costs to acquire a new customer. You can use CAC to figure out how long it takes to make back your acquisition costs, a.k.a. your time to pay back CAC.

-

Customer lifetime value (LTV) is the predicted amount of revenue that a customer will generate throughout their entire relationship with your business. From there, your LTV:CAC ratio tells you whether you’re spending too much or too little to bring in new customers, so you can adjust your marketing budget accordingly.

-

Customer churn rate tells you how many repeat customers your business loses over a set period of time. Reducing your churn rate is an excellent way to increase your LTV and grow your business.

Whichever marketing metrics you’re trying to improve, remember that you can always try new channels and tactics for a month or two, then recalculate. There’s always room to grow, and these formulas can help you keep your business on track as you do.