You know what’s awesome about being a small business owner?

You get to run your schedule.

You get to do work that is meaningful to you.

You can even build a business that runs without you.

And you know that your efforts will positively impact someone’s life.

But there are things about running a business that aren’t so awesome.

Like learning how to start a business, finding the essential tools to run your business, writing business plans, and paying taxes. That first is one of the most common excuses would-be entrepreneurs struggle with, and it's understandable.

After all, requirements for setting up your business can get knotty. Every state, country, and sometimes even city, has different regulations, which is why you should always seek legal counsel before setting up shop.

Still, it never hurts to get a little help from a friend -- especially one with a penchant for data, real-world examples, and helpful links -- and that’s exactly what you’re getting today.

Today, we’ll walk you through six simple steps towards opening your first business and turning your idea into a reality.

Before we get into the nitty-gritty of setting up a business, however, we should probably go over the need-to-know parts before you start your business.

What should I know before starting my first business?

Before starting your business, you should research:

-

Which business entity is the best for you

-

Your city, state, and nation’s rules for registering a business

-

Financial, professional, and legal risks to avoid

-

How much money you’ll need to register and run the business

-

What taxes you’ll have to pay and when

-

A business plan

Not as bad as you thought, right? In the steps below, we’ll dive into what each point entails and why it’s so critical for your business success.

Step #1. Research which business entity is the best for you

If you live in the United States, the IRS lists six main business types to choose from.

Each business structure provides different legal and tax advantages for its owners, so make sure to review each one before deciding.

That said, there are two business types that are particularly popular for small businesses -- sole proprietorships and LLCs -- so if you’re looking for a shortcut, they’re a good place to start.

Let’s take a look at them now.

Sole proprietorships

Sole proprietorships are one of the most popular business structures out there and are solopreneur-friendly.

Sole proprietorships don’t require any paperwork to establish and begin once the owner starts their business activities.

One positive of being a sole proprietor is that your earnings are not taxed differently since there is no distinction between the company and the owner’s earnings.

However, sole proprietorships also expose owners to unlimited personal liability for the business’ activities since there is no legal distinction between the business and the owner.

Financially speaking, sole proprietorships can run into some hiccups.

Sole proprietors must pay self-employment tax and quarterly estimated taxes on their earnings, which can take an unexpected chunk out of their profits.

They might also have difficulty receiving bank loans since they can be perceived as being riskier and less professional than other business structures.

If you’re looking for some legal protection and a distinction between your business and personal activities, a limited liability company (LLC) may be a better choice.

Limited Liability Companies

Each state defines and regulates LLCs differently, but broadly speaking, LLCs protect the owners’ finances and assets if the business should get sued.

Luckily for small business owners, LLCs aren’t a one-size-fits-all kind of business structure -- most states allow owners to specify what kind of LLC they operate.

For example, many states allow LLCs to have one or multiple owners, with these owners referred to as “members”.

LLC’s can be either member-managed or manager-managed (try saying that five times fast).

Essentially, a member-managed LLC means one or more of the owners can make decisions on behalf of the entire company, such as opening a business bank account or signing legally-binding contracts.

Conversely, manager-managed LLCs give this decision-making power to one or a few members only, or even a non-member.

When it comes to taxation, LLCs have the option of being taxed as a disregarded entity, partnership, C corporation, or an S corporation.

As a reminder: Because tax laws in the United States can get gnarly, we recommend you speak with an accountant and lawyer before picking a business or tax structure, but these should give you the building blocks to start the conversation.

After you decide on a business entity, your next step is to figure out how to officially register your business.

Step #2. Learn the rules for setting up a business in your nation, state, and city

Rules for setting up a business vary significantly from state to state, and even from city to city.

While the information below applies mostly to U.S.-based entrepreneurs, creators in the U.K. can find out more about setting up a business through the GOV.UK website, while those in Europe can find out more from the EBR.

When it comes to learning about business regulations in your country, you’ll want to see if you need to:

-

Fill out paperwork and pay filing fees

-

File annual reports and pay annual fees

-

Register a fictitious name or DBA name

-

Find a registered agent

Beyond exploring these common requirements, visit your respective secretary of state or department of revenue website to determine what else they require of new businesses.

And get ready for the paperwork, because that’s your first (sub) step.

A: Fill out paperwork and pay your fees

If you’re starting a corporation or LLC, you’ll need to fill out a document called the articles of incorporation (for corporations) or articles of organization (for LLCs), as in this example for Nevada residents.

Basically, this is the document you submit to your state to notify them you are opening your business.

At the very least, this form will require:

-

Your name and the names of other owners

-

The business’ name and address

-

The kind of business activity that your business will offer

-

The name and contact information of your registered agent

-

The date when your business will officially begin operation

-

Contact information

The form may also ask when the business will close if you don’t plan on running it indefinitely and if it will be member-managed or manager-managed.

Paperwork to register your business doesn’t always end with the articles of incorporation or organization; many states will also require you to fill out a fictitious name form, too.

B: Register your fictitious name

A fictitious name -- also known as a “doing business as” or “DBA” name -- is simply another name you use to conduct business aside from the official name you gave to your state government.

Many businesses choose to use a fictitious name in addition to their legal business name for the sake of sounding catchy and memorable.

Fortunately for business owners, fictitious name forms are usually more straightforward than other paperwork you might have to fill out, such as this fictitious name form from Missouri.

Keep in mind, however, that many states will require you to publish your fictitious name in a newspaper or professional publication so the public knows you’re doing business under a different name.

Unfortunately, we’re not quite done with paperwork yet after your registration and/or DBA form. You may need to file annual reports, too.

C: Find out if you need to file an annual report

First, the good news: Not all states require an annual report.

The bad news: Many of them do.

Unlike the annual reports companies give to their shareholders, the reports given to your state’s government are usually much simpler.

Most annual reports will ask you to include basic information about your business, like your name, the name of your registered agent, and your business activity.

While it may seem unimportant to file an annual report as a business of one, you should always try to submit your annual report on time -- otherwise, you may be subject to fees or have your company dissolved.

Scary, I know. That’s why it’s important to get this stuff out of the way earlier and prepare yourself.

Fortunately, a registered agent -- the final piece of your paperwork adventure -- can take some of the weight off.

D. Find a registered agent

Registered agents are third-parties who help maintain legal privacy while running your business.

Registered agents can accept paperwork on your business’ behalf, such as state and federal communications or IRS tax notifications, and then forward it to you.

A registered agent is also a reliable place to have business documents sent if you move but don’t update your address on official documents or don’t want to be served in your place of business.

Even if your state allows you to be your own registered agent, hiring one can give you some much-needed peace of mind and help in managing business correspondence.

Speaking of peace of mind, you should ensure your business does its best to avoid financial, professional, and legal risks as well, which we’ll cover next.

Step #3. Financial, professional, and legal risks to avoid

Whenever you start a business, you open yourself up to risk regardless of how cautious you are.

While the specific risks will vary, make sure to check with your accountant and lawyer to determine what financial risks you may encounter as a small business owner and what you can do to mitigate them.

Don’t forget to also consult with professional organizations in your niche to determine if there are any special licenses or certificates you need to be a practitioner or avoid legal complications.

Whatever you do, it’s critical that you avoid doing things that would cause a court to “pierce the corporate veil.”

Piercing the corporate veil means giving a court any cause to disregard your liability and hold you/the other owners responsible for your business’ debts and actions.

The criteria for determining if the corporate veil has been pierced can get pretty complicated, but it boils down to:

-

Did the business have adequate money to run itself since its beginning?

-

Did it misrepresent how much money it had and its ability to pay debts?

-

Did the business follow the formalities needed for running the business?

On that note, even if you’re certain your company is run meticulously, you should still think about getting business insurance.

44% of small business owners skip buying it because of the cost and the perceived low chance of getting sued.

However, not having insurance can make your business vulnerable to lawsuits that can not only crush your business, but your personal finances as well.

That’s definitely something you want to avoid.

As for how to choose insurance, your best bet is to choose a plan in concert with your legal and financial advisors and determine what level of risk you’re willing to deal with.

Otherwise, you may end up like this contractor who was denied his general liability coverage after his subcontractors caused damage that racked up six million dollars worth of repairs.

Let’s be clear: It may not seem like a huge risk to skip insurance, but it is, and it’s a risk that many business owners take despite identifying as “not a risk taker”.

How many? 43% of small business owners say they aren’t risk takers, but 53% of businesses making less than $50,000 a year in gross revenue said that they don’t have insurance.

So as you can see, the disconnect between perceived risk-taking and actual risk-taking can be significant.

While it may not seem to make sense for a business with small profits to purchase insurance, these are precisely the kinds of businesses that could be ruined by a lawsuit or hefty government fee.

Of course, insurance costs are just one of the things you’ll have to include when you calculate your monthly expenses and runway (more on what this is in a minute).

Step #4. Calculate your expenses and find a business bank account

If you’re worried that you may not have the money to start your business, consider these statistics:

-

Around one-third of businesses started with less than $5,000

-

65% of business owners were not completely confident that they had enough money to start their business

-

36% of entrepreneurs didn’t calculate their run rate before opening their business

And while you may think that you could open your business for just a few hundred dollars, you may want to recalculate a few things since business-related expenses have a knack for adding up unexpectedly.

Consider the expense of filing articles or organization, which are used to register your LLC.

In Tennessee, the cost to file the articles of organization is a minimum of $300 and a maximum of $3,000.

In Pennsylvania, the articles or organization will cost you $125, but only $70 to file in California and $50 in Arizona.

But then you need to consider the additional forms and requirements after you’ve officially registered your business, including:

-

Registering a fictitious name

-

Hiring a registered agent

-

Consulting with a lawyer and accountant

-

Purchasing business insurance

-

Purchasing a business P.O. box

-

Other fees specific to your state, such as annual report filing fees or franchise taxes

-

Health insurance if you don’t have any or if you have employees

Additionally, after you've done things to start the business legally, you’ll still need to purchase tools to keep your business running.

Even if you’re an exclusively online business, you’ll still need to pay for:

-

A domain name for your website

-

An email tool like MailChimp so that you can keep in contact with your subscribers

-

A place like Podia to host your online courses and memberships

Other useful tools and strategies to use if your budget allows include:

-

Accounting software like QuickBooks

-

A scheduling tool like Calendly for meetings

-

Live chat programs like Drift

-

Social proof tools like ProveSource

-

Business cards

All of that can add up pretty quickly.

But aside from these startup costs, you should also determine how much money you’ll need for the few months after you open your business.

While there's no hard-and-fast rule, planning for at least a year of expenses ensures you'll have enough money (or choose the right small business term loan) to keep you covered as your business grows.

It’s easier than it sounds. Let me walk you through it.

First, calculate your business burn rate, or how much money you spend each month on the tools, inventory, and salaries needed to run your company.

Next, calculate your runway, which is how many months or years you can be in operation using your existing cash.

This can give you a better idea of not only what tools your business can afford, but also how you should price your products, how many clients you’ll need, and how aggressively you should promote your brand.

If you think you may need money besides personal savings and business earnings to run your business, this course on small business financing options from the Small Business Administration could help.

After determining your expenses and before paying taxes, there are two more things to do: Get an employer identification number and open a business bank account.

An employer identification number (EIN) is simply a unique number used to identify a business and similar to how Social Security numbers can identify individuals.

Many businesses will need an EIN to do things like file taxes and open a business bank account.

In fact, 70% of small business owners who didn’t have a business checking out were denied a business loan in the preceding two years.

And to get a business bank account, you almost always need an EIN.

But even after you’ve obtained your EIN and business bank account, you still have one more important financial task: figuring out your tax situation.

Step #5. Determine what taxes you’ll need to pay

When you run a business, it’s crucial to pay your taxes on time.

Small business owners (with a few notable exceptions) must pay taxes every quarter in addition to their annual filing at the beginning of the next year.

Keep in mind that even though the IRS uses these dates for federal quarterly taxes, your state and city/county may have different dates for when quarterlies are due.

For example, residents of Allegheny County in Pennsylvania pay the second quarter taxes by July 15 and not June 15, as they would for federal taxes.

Many small business owners are also shocked that in addition to paying the federal tax that aligns with their tax bracket, they must pay the full Social Security and Medicare taxes (12.4% and 2.9%, respectively, at the time of writing).

When you’re a full-time employee, the Social Security and Medicare taxes are split between you and your employer -- each of you will pay 6.2% and 1.45% towards the respective taxes.

But since you are your employer, you’ll be responsible for paying this 15.3% tax in addition to your federal, state, and local taxes.

Certain cities and counties across the United States charge an additional local tax for residents, as well.

Kansas City, Missouri charges a 1% income tax on residents, but cities like Aurora, Colorado charge a flat fee for earnings over a certain level.

While you’re researching taxes, don’t forget to see if you will have to pay any taxes specific to your state or niche, such as the minimum franchise tax for California businesses.

Depending on your state’s rules, you may also need to collect sales tax on the sale of your goods and services or pay a use tax for purchases that you didn't pay tax on.

However, not all states’ laws have kept up-to-date with the various digital products that are available for sale, so we recommend you consult with a lawyer before charging sales tax.

Once all of the formalities of setting your business up are all done, the fun begins -- setting up your business plan.

Step #6. Set up your business plan

To figure out how you’ll make money as a freelancer and/or small business owner, you’ll need a business plan.

A business plan is essential to ensure you start on the right foot and stay on track through the highs and lows of operating.

Minimally, your business plan should include:

-

Research about your audience, competitors, and overall industry

-

A SWOT analysis for your company

-

Research about the problem your customers are having

-

How your product or service is a worthwhile and profitable solution to that problem

-

Your business model (Haven't picked one? Check out this article on starting an online business to dig into models.)

-

How much money you currently have, your projected monthly cash flow and expenses, and your anticipated profits

-

How you plan on growing and scaling your business

-

Your marketing strategies (Don't have these at-hand either? No problem. Here's how to market a new product.)

Not sure how to start your business plan? This free tool from the SBA, this one-page business plan template from HubSpot, and this guide to conducting a SWOT analysis can help you get started.

Once you’ve put together your business plan, you’re probably feeling like there’s no way that one person could do all of this -- and you’re right.

That’s what business tools are made for.

What tools can I use to make running my business easier?

There’s no shame in not managing every single aspect of your business.

According to one entrepreneur, “. . . recognizing that I needed help and bringing on a team member has been the single smartest decision I've made as a business owner.”

She’s not the only one who feels that way.

While you may not be able to hire someone just yet, there are hundreds of software programs available that can make running your business much easier.

Here are some of the most important:

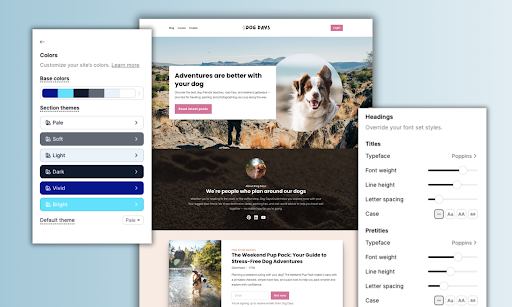

Setting up your website and hosting your products

Around 40% of small businesses don’t have a website, which is a huge no-no if you want to grow your business from a mere idea to a viable source of income.

Sites like Weebly, WordPress, Squarespace, and Carrd.co all have reasonably-priced plans so that you can put together your business website in just a few hours.

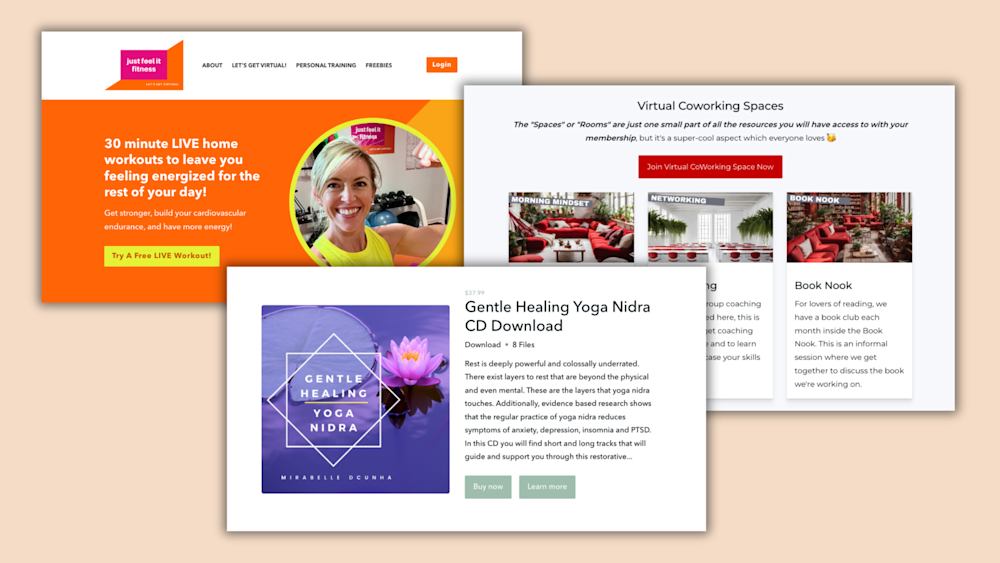

But aside from having a place for customers to learn more about you, you’ll need somewhere to host and sell your online products, too.

Now, we are a little biased since we help digital creators host and sell products, but with over 20,000 creators on our platform, we recommend you checkout Podia and compare us with other platforms.

No matter what platform you end up choosing, you’ll still need a robust marketing strategy to really make your products shine -- and we know just the tools that you can use to do that.

Using marketing tools to reach and convert more customers

You know those wonderful products in your website?

You need to use different marketing strategies so your customers can find them.

That’s why you’ll want to use social media scheduling tools like Buffer and SocialPilot to share information about your products -- and anything else that your audience may find interesting.

Any scheduling tool worth its weight will also have ways for you to measure how many people have seen your posts, how they’re interacting with them, and a host of other important metrics.

Having difficulty figuring out what to write about on your company’s blog?

Use tools like BuzzSumo and GoogleTrends to find out what people are reading about and searching for, respectively.

If you’re more of a hands-on person, you can also go to discussion forums like Reddit and Quora to answer and ask questions from your audience and get inspiration for content.

At the end of the day, make sure that your marketing efforts serve the customer first and your sales second.

By serving the customer, we don’t just mean giving them a great product -- we mean giving them a great customer experience and making them feel genuinely valued and appreciated.

Customers who feel a connection with a brand have a 306% higher lifetime value than those who don’t and tend to stick with the brand for longer, too.

That’s a great ROI from just taking the time to show your customers that you care about them.

However, although your loyal customers will take care of providing you with a steady cash flow, it’s up to you to manage and allocate that money so that your business can grow.

Lucky for you, there’s a wide selection of tools out there to help you manage your business’ finances like a pro.

Managing your business finances

Keeping track of taxes and bills can be a huge hassle for even the most seasoned entrepreneurs out there.

Make things easier for yourself by using tools like QuickBooks that help you keep track of your earnings, send invoices, and track expenses.

Tools like Stripe, PayPal, and Payoneer can help you to access payments from customers around the world without having to worry about currency conversions.

If you really want to streamline your finances, you could use Podia to host and sell your digital products.

We don’t make you wait to receive money from your creators, or charge transaction fees -- as soon as they buy something from you, the full amount is in your account. There’s also a nifty dashboard to access your sales data, too.

OK. The final tool for a day isn’t a tool per se, but we can’t recommend it enough: The sooner you get a mentor, the faster you’ll grow.

Leverage a business mentor to elevate your business

Research has consistently shown that working with a mentor is beneficial for business’ success.

Your business mentor can be pretty much anyone who has more business experience than you and who can guide you in your journey, be that a coworker, someone in your community, or even a free mentor that you find through an organization like SCORE.

When it comes to finding a mentor, don’t feel like you have to wait until you reach a certain revenue milestone or have been in business for X years to find one.

Mentors can help you throughout all stages of the journey, from finding startup money to scaling your business after being in operation for years.

Best of all, mentors are an extra person to have on your side as you navigate the entrepreneurial word -- who wouldn’t want that?

Start your small business off on the right foot

True, there is a lot of paperwork you’ll have to fill out when first starting your business.

But we promise things are not nearly as complicated as they seem.

When it comes to starting a business, there are just a few key things you’ll have to consider, including:

-

Which business entity -- an LLC, corporation, sole proprietorship, et cetera -- is the best for your business

-

What rules your nation, state, and city have for setting up a business

-

What you’ll need to do to keep your business in good standing, like paying taxes on time and avoiding professional risk

-

How much money and what resources you need to run your business

-

A business plan to cover you for the next few months

-

How you’ll sell your products -- on your own website, an online marketplace, or a physical store

And after you’ve done all that, the magic begins. Your dream becomes a reality.

Definitely worth a little paperwork, yeah?